Motorcar and boat sales are taxed at only the 6.25% condition level; there isn't a area sales and use tax on these items. Additionally, a motor vehicle or boat ordered outside the house the condition is assessed a use tax at the same charge as 1 ordered In the state.

Inside the hospitality market it really is popular for restaurants and hotels to cost a tax price higher when compared to the point out sales tax rate. Examine with your state and locality for expected sales tax premiums and potential tax surcharge rates.

Irrespective of whether you’re delivery an item, giving labor and solutions, or leasing or leasing tangible private home, all figure out the speed of sales tax to charge.

Organizations will have to sign up Every spot to gather, report and pay sales tax. You are able to register utilizing the online registration method or post a paper Florida Business Tax Application (Type DR-1 ). Helpful July one, 2021, Florida regulation needs corporations producing remote sales in the condition to collect and electronically remit sales and use tax, which includes any applicable discretionary sales surtax, on People transactions In case the small business has made taxable distant sales in excessive of $a hundred,000 in excess of the prior calendar yr.

On 1 July 2008, Washington stopped charging an origin-centered sales tax, and began charging a spot-dependent sales tax. This variation only applies to transactions beginning and ending inside state lines and does not implement to other states.

Free financial nexus evaluation Find out wherever you might have sales tax obligations Software Economic nexus information Know how economic nexus rules are determined by point out Sales tax laws See which nexus legal guidelines are in spot for each condition TAX Costs

Sign on and we’ll send you Nerdy posts regarding the cash subjects that matter most to you personally along with other methods that will help you get far more from your money.

Most states also exempt bulk sales, which include sales of an entire organization. Most states exempt from sales tax goods acquired for use as ingredients or sections in additional manufacturing. Consumers in exempt sales will have to abide by specified strategies or facial area tax.

Sales tax and discretionary sales surtax are calculated on each taxable transaction. Florida employs a bracket procedure for calculating sales tax in the event the transaction falls between two whole greenback quantities.

Once you electronically file your sales and use tax return and electronically spend well timed, you might be allowed to deduct a group allowance. The collection allowance is two.five% (.025) of the first $one,200 of tax thanks, to not exceed $thirty. In case you file paper returns plus the twentieth falls on the Saturday, Sunday, or state or federal holiday break, your return and payment are deemed timely if postmarked or hand-delivered on the first organization working day subsequent the twentieth. You can sign up to acquire because of date reminder e-mail for every reporting period. These e-mails can be a easy way to assist you to file and shell out well timed. When you file your return or shell out tax late, a late filing penalty of 10% of the level of tax owed, but not fewer than $fifty, could possibly be charged. The $50 minimum amount penalty applies even if no tax is because of. A floating charge of desire applies to underpayments and late payments of tax. Interest charges can be found on the Division's Tax and Curiosity Premiums webpage. Submitting Frequency

Hawaii also imposes a "use tax" on corporations that offer expert services which can be "LANDED" In Hawaii. A person example is: A home owner in Hawaii contracts that has a mainland architect to design and style their Hawaii home. Although the architect Potentially does all of their perform in a very mainland site, the architect must pay back the Condition of Hawaii a 4% use tax over the architect's charge because the created dwelling is situated in Hawaii (whether or not your house isn't designed).

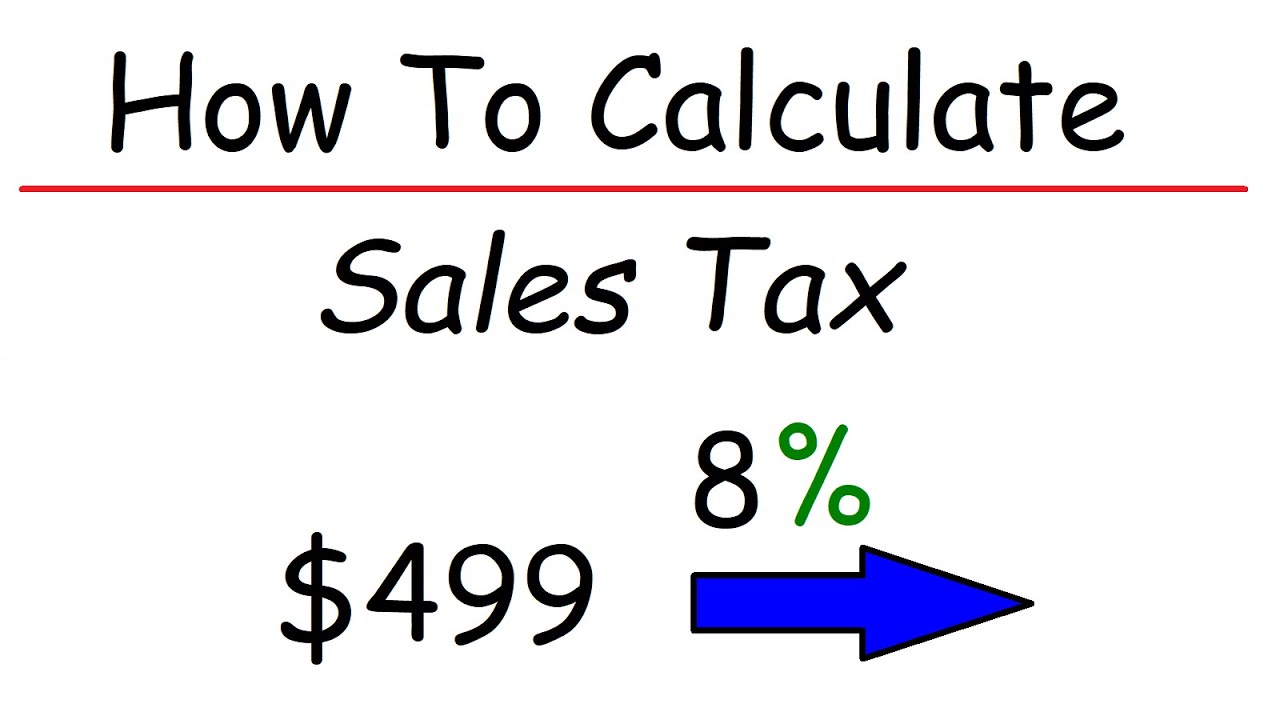

Sales tax rates can alter as time passes—the calculator provides estimates according to latest readily available costs.

So if you’ve been itemizing your tax return and you live in a point out with significant cash flow taxes or else you individual a house in a ny sales tax location with significant property taxes, there is probably not Significantly home for this deduction.

Sales to businesses also to people are commonly taxed exactly the same, apart from as famous within the preceding paragraph. Organizations receive no offset to sales tax selection and payment obligations for their own individual purchases. This differs drastically from benefit included taxes.